s corp estimated tax calculator

Partnership Sole Proprietorship LLC. It will take into account any factors that can affect your savings.

Paycheck Calculator Take Home Pay Calculator

Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is.

. For example if you have a. S-Corp or LLC making 2553 election. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Then find a CPA or qualified tax pro. Income losses deductions and credits flow through to the shareholders. If your company is taxed at a high level try our S Corp tax savings calculator.

Generally an S corporation must make installment payments of estimated tax for the following taxes if the total of these. Estimated payments are portioned into four payment intervals throughout the year. Income for April 1 to May 31.

Check each option youd like to calculate for. And your QBI deduction would be 2000 10000 x 02. An S corporation is a corporation that elects to be taxed as a pass-through entity.

Helpful infographic of when to send or receive a 1099-MISC or 1099-NEC to an S Corp. From the authors of Limited Liability Companies for Dummies. We are not the biggest.

Forming an S-corporation can help save taxes. Income for January 1 through March 31. Sometimes an S corporation must make estimated tax payments.

Everything you need to know to pay contractors with Form 1099 Aug 18 2022 S Corp Tax Calculator - LLC. For example if your one-person S corporation makes 200000 in profit and a. Doing business in California7.

S-Corp Calculator Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. This calculator helps you estimate your potential savings. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

Just complete the fields below with your best estimates and then register to get your CPA or schedule a free. If you have 20000 in 1099 income and 10000 in business expenses your net income is 10000. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Heres how it works. The SE tax rate for business owners is 153 tax. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to.

C-Corp or LLC making 8832 election.

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

How Business Owners May Be Able To Reduce Tax By Using An S Corporation Ullrich Delevati

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Tax Savings Calculator For Llc Vs S Corp Gusto

Small Business Tax Calculator Taxfyle

Small Business Tax Calculator Taxfyle

Llc And S Corporation Income Tax Example Tax Hack

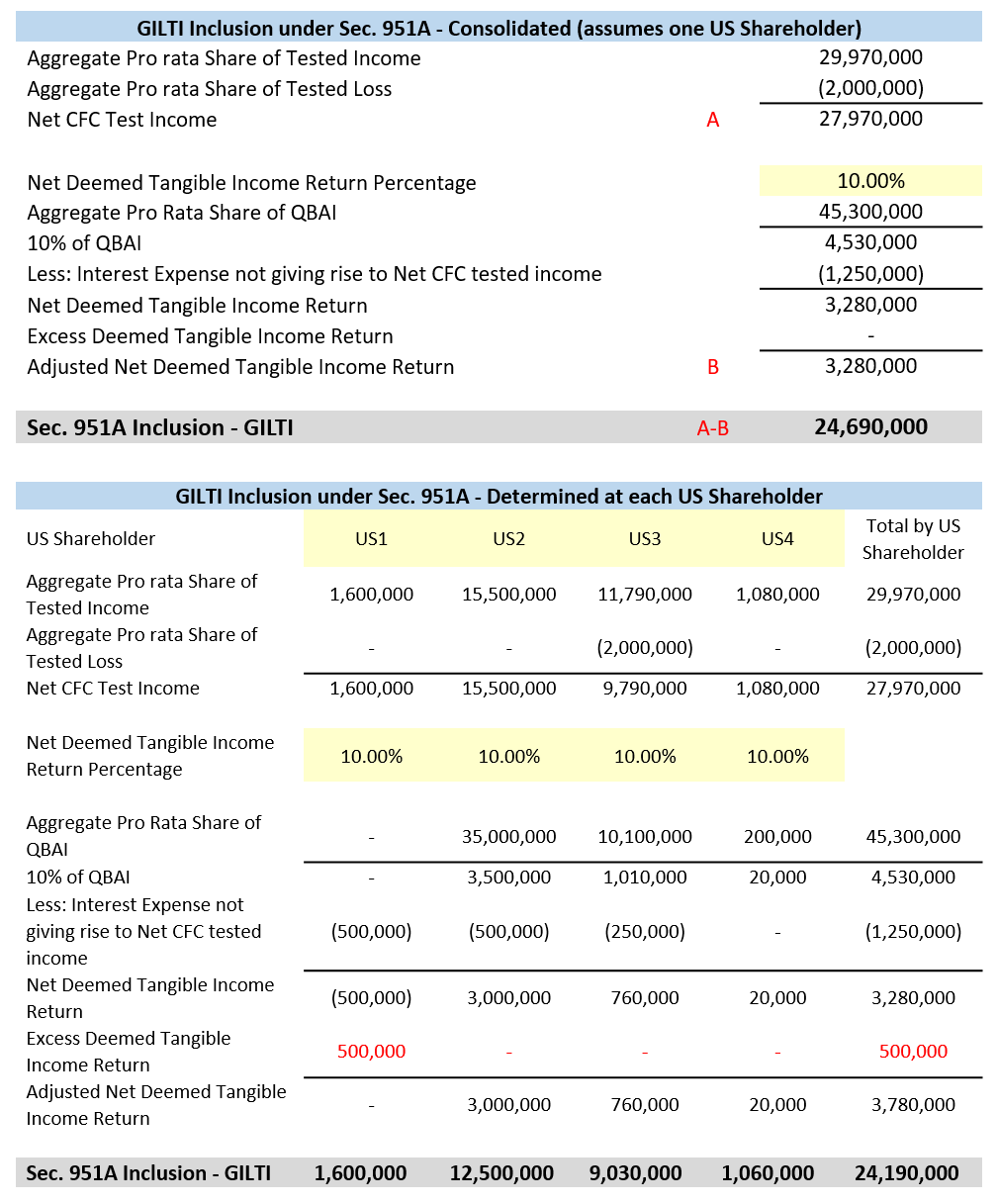

Gilti Detailed Calculation Example

S Corp Vs Llc Difference Between Llc And S Corp Truic

Free Llc Tax Calculator How To File Llc Taxes Embroker

How To File S Corp Taxes Maximize Deductions White Coat Investor

Determining The Taxability Of S Corporation Distributions Part I

How Much Does A Small Business Pay In Taxes

Corporate Tax Meaning Calculation Examples Planning

S Corp Vs Llc Difference Between Llc And S Corp Truic